delayed draw term loan commitment fee

The fee amount accumulates on the portion of the undrawn loan until the loan is either fully used terminated by the borrower or the commitment period expires. When a company borrows money either through a term loan or a bond it usually incurs third party financing fees called debt issuance costs.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Introduction to financing fees.

. Able to secure a DDTL in a large-cap transaction with the ticking fee set at 1 for the entire two years of the DDTL commitment period. This Credit Agreement dated as of August 31. The ticking fee is due until.

The closing date through one year following the. The Borrower shall pay a commitment fee of 50 of the interest rate margin with respect to LIBOR borrowings per annum in each case on the daily average unused portion of the Delayed-Draw Term Loan Facility payable quarterly in arrears on the last day of each fiscal quarter commencing with the first full fiscal quarter ending after the Closing Date with the. Total DDTL commitments ie 1 million pay-.

In addition to a ticking fee you may be on the hook for an upfront fee when you close on your loan. DDTLs also include an upfront fee which is usually payable to the lend. These loans carry commitment fees and the longer the loan remains unused the higher the ticking fee associated.

If you take out a DDTL youll be responsible for a ticking fee. DDTLs carry ticking fees akin to commitment fees which are payable during the commitment period on the unused portion of. USA February 13 2018.

These are fees paid by the borrower to the bankers lawyers and anyone else involved in arranging the financing. That is when a loan is modified unamortized fees should continue to be deferred new creditor fees should be capitalized and amortized as part of the effective yield and new fees paid to third parties should be expensed. Delayed-draw term loans or DDTLs of up to two years are standard features of financing from private credit providers.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender. On and after the Closing Date the US Borrower shall pay to the Administrative Agent for the account of each Delayed Draw Term Lender in accordance with its Pro Rata Share a ticking fee each a Delayed Draw Term Commitment Ticking Fee and collectively the Delayed Draw Term Commitment Ticking Fees equal to the.

Fees and expenses the interest portion of any deferred payment obligation amortization of discount or premium if any and all other non-cash interest expense other than interest and other charges amortized to. That is the fees are paid whether or not the funds are ever drawn down. The increased use of the.

Delayed Draw Term Commitment Ticking Fee. Able on the closing date on a nonrefundable basis. A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds available to the borrower for a certain period of time.

1 Section 101. A ticking fee accumulates on the portion of the undrawn loan until you either use the loan entirely terminate it or the period of commitment expires. Delayed draw term loans are a flexible way for borrowers usually with the backing of sponsors to finance incremental acquisitions after a significant transaction.

For example at the origination of the loan the lender and borrower may agree to. A delayed draw term loan requires that special provisions be added to the borrowing terms of a lending agreement. The failure of any Lender to make any Loan shall not in itself relieve any other.

Repayment of Loans. The fee can be a flat amount such as 1000 or a percentage of the loan amount such as 1. Their appeal is one reason borrowers have moved toward the private debt market sometimes at the expense of syndicated loans.

DELAYED DRAW TERM LOAN CREDIT AGREEMENT. Parties further continue to negotiate the upfront feeOID structure for DDTLs ie what percentage of such fees are payable at closing and what percentage are payable at draw. The loan is terminated by the borrower.

The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation. 137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. The Borrower shall repay the outstanding principal amount of the Delayed Draw Term Loan on the last Business Day of each Fiscal Quarter commencing with the first 1st Fiscal Quarter of 2019 in each case in an amount equal to one and one-quarter percent 125 of the outstanding principal amount of the Delayed Draw Term Loan as of the last day of the first 1st Fiscal.

In term loans that have delayed draw mechanics the commitment fee typically referred to in this context as a ticking fee is payable on the unfunded commitments. Closing date and z 2 for the period after one. The loans come with a host of fees and some restrictions.

While the fee structure for DDTLs has always been a negotiated point and has varied based on the actual arrangements sponsorsborrowers and debt providers the migration of the DDTL tranche upmarket has put the spotlight on some of those economics. By contrast term A loans are usually disbursed in installments during. 2 a 1 Closing Fee calculated as a percentage of.

The commitment fee is typically lower than the interest rate that is charged on the drawn portion of the loans. The full value of the loan is used up. In the case of a one-time loan the commitment fee is negotiated between the lender and the borrower.

In the years of strong credit markets prior to the COVID-19 pandemic documents governing DDTLs. Prior to April 2015 financing fees were treated as a long-term asset and amortized over the term of. Such Lender will have no further commitment to fund Loans hereunder.

We believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10. This CLE course will discuss the terms and structuring of delayed draw term loans. When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term.

The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of time the borrower can use the undrawn value of the loan. Term B loans are usually disbursed in a single advance so the commitment fee is payable on the entire amount of the facility until it is funded. ARTICLE I DEFINITIONS AND ACCOUNTING TERMS.

Year following the closing date. Recorded event now available. DDTLs were used in bespoke arrangements.

Financing Fees Deferred Capitalized Amortized

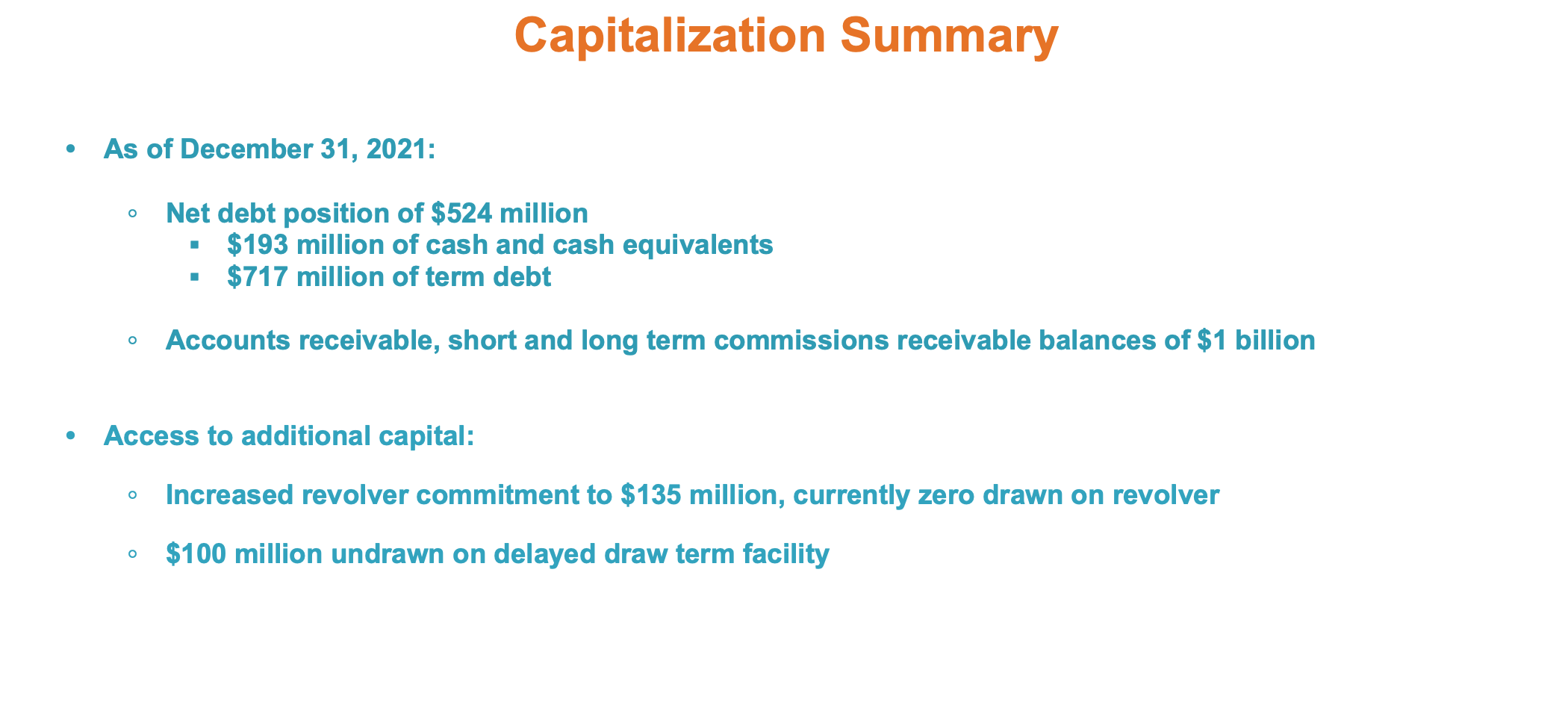

Selectquote Stock This Did Not Turn Out As Planned Nyse Slqt Seeking Alpha

How To Calculate An Interest Reserve For A Construction Loan Propertymetrics

Financing Fees Deferred Capitalized Amortized

Delayed Draw Term Loan Ddtl Overview Structure Benefits

A First Time Buyers Guide To Understanding The Construction Loan Process Newhomesource Home Improvement Loans Construction Loans Home Construction

Houlihan Lokey Advises Cerberus Capital Management Transaction Details

Mortgage Commitment Letter Sample Lettering Job Cover Letter Letter Sample

Delayed Draw Term Loans Financial Edge

Healthcare M A Healthcare Financing Restructuring Houlihan Lokey

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

Corporate Finance Houlihan Lokey

Letter Of Commitment Overview Example And Contents

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management

Financing Fees Deferred Capitalized Amortized

Infographics Types Of Bank Guarantees Bg Providers Trade Finance Bank Infographic

/GettyImages-1162280946-fdd66d8f3cd94022885927e27d132192.jpg)