sales tax on leased cars in illinois

When an Illinois resident purchases a vehicle from an out-of-state dealer and will title the car in Illinois the sale and subsequent tax due is reported on Form RUT-25 when you bring the. Money down and trades plus your monthly payment.

For vehicles that are being rented or leased see see taxation of leases and.

. 1 the Illinois law will change so that sales tax applies to the down payment and monthly lease payments. Form RUT-50 Private Party Vehicle Use Tax Transaction Return. Form RUT-50 is generally obtained when you license and title your vehicle at the local drivers license facility or currency.

If the down payment is 2000 the tax on that would. This post provides an overview of the retailers occupation tax ie. While Illinois sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

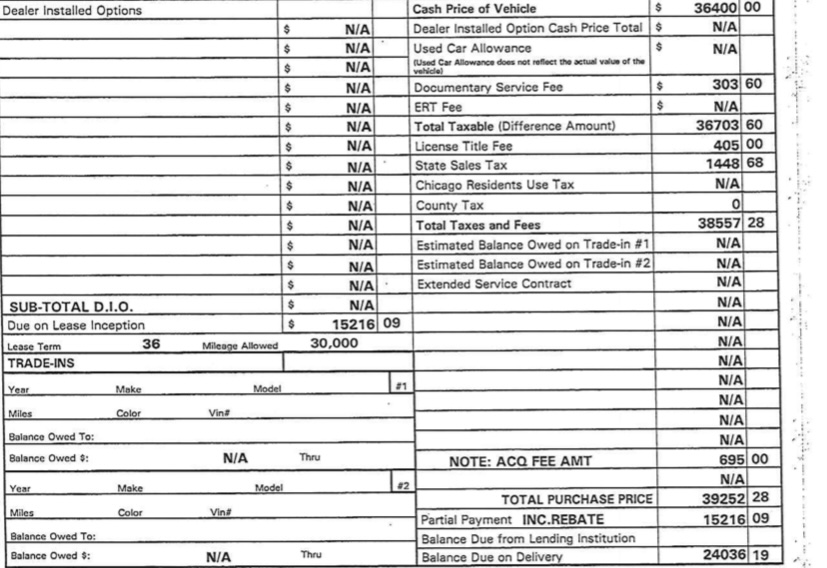

Illinois taxes you on any rebates and cap cost reductions ie. Calculate Car Sales Tax in Illinois Example. In other states such as Illinois and Texas see Texas Auto Leasing you actually pay sales tax on the full value of the leased car not just the leased value just as if you were buying it.

Sales tax and use tax consequences of leasing equipment in Illinois. In addition Chicago levies an 8 percent use tax on leased vehicles on top of the sales tax. With the new Illinois tax law a sales new tax will be applied to a trade-in value above 10000.

This page describes the taxability of. What is a lease. Sales tax is a part of buying and leasing cars in states that charge it.

If the down payment is 2000 the tax on that would be 165. Most people deduct income tax but in the case that you made several large purchases you will. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

Buying Leasing Selling - Chevy Volt. Sales tax and use tax consequences of leasing equipment in Illinois. Tags illinois lease leasing sales tax.

The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in. Like with any purchase the rules on when and how much sales tax youll. Heres an explanation for.

In Illinois you will pay monthly taxes as of January 1 2015 see Illinois Car Lease Tax. For example if you trade-in your current Volkswagen and receive a trade-in value of 10000. If you are in Chicago it is 95 this is separate from the.

This page covers the most important aspects of Illinois sales tax with respects to vehicle purchases. Sales tax is a part of. Illinois Changes Sales Tax on Leased Cars.

Sedan Vehicles Enterprise Car Sales

Tesla Lease Guide Prices Estimated Payments Faqs And More Electrek

Illinois Trade In Tax Coming Chicago Il Marino Cdjr

How To Get Illinois 4 000 Electric Vehicle Rebate Wbez Chicago

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

How To Negotiate A Car Lease Credit Karma

Illinois Sales Tax Rate Rates Calculator Avalara

Used Car New Honda Dealership In Marion Il Auto Service In Carbondale Ike Honda

How Do I Sell My Leased Car To A Third Party

Which Are The Cheapest Electric Cars To Lease

Sales Taxes In The United States Wikipedia

Virginia Sales Tax On Cars Everything You Need To Know

Car Lease Ending Soon Another One May Not Be Your Best Option